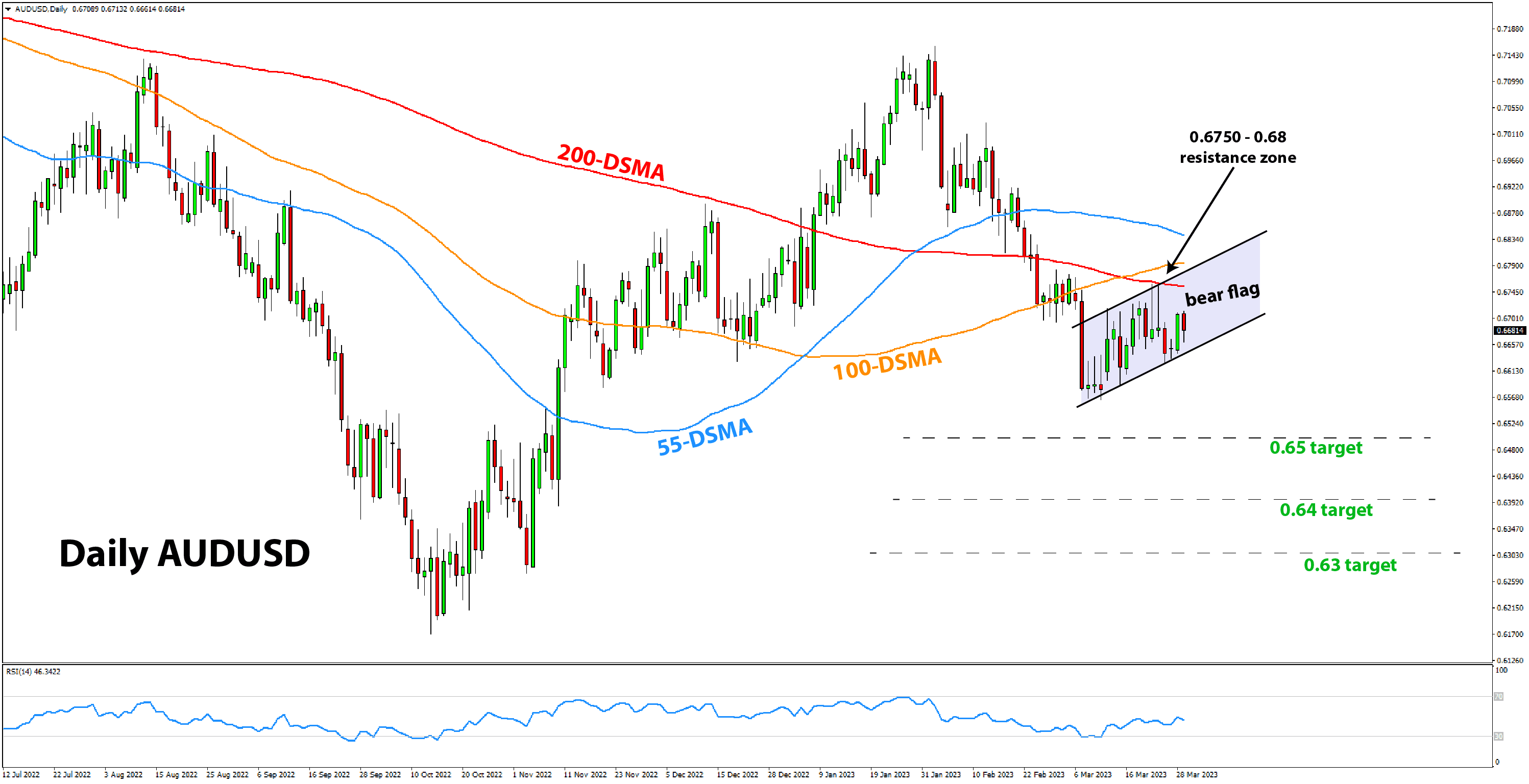

As we can see on the AUDUSD chart below, the pair is stuck in a range while the banking crisis was unfolding in the US and Europe over the past 2-3 weeks. There was a big drop in AUDUSD on March 7 (tall red candle), but that was before the worst of the Silicon Valley Bank (SVB) unfolded.

It is also true that the impact on global risk sentiment is very limited so far. Central banks and Government authorities reacted quickly and managed the SVB and Credit Suisse collapses without allowing contagion to spread to other troubled banks so far. Risk sentiment remains supported across all markets, with stocks near unchanged levels as well as risk-sensitive currencies like AUD and NZD.

Nonetheless, the situation remains fragile. Whenever a bank fails, markets remain on edge. This sense of cautiousness will linger among traders and investors. Consequently, any further worsening of the situation for banks, could quickly develop in a larger risk aversion sell-off. Currencies like the Aussie will be vulnerable in such a situation. Hence a bearish break in AUDUSD would be the likely outcome.