FxTR Profitable Forex Newsletter

Hey! This is Philip with this week's edition of the FxTR Trade Idea

Newsletter!

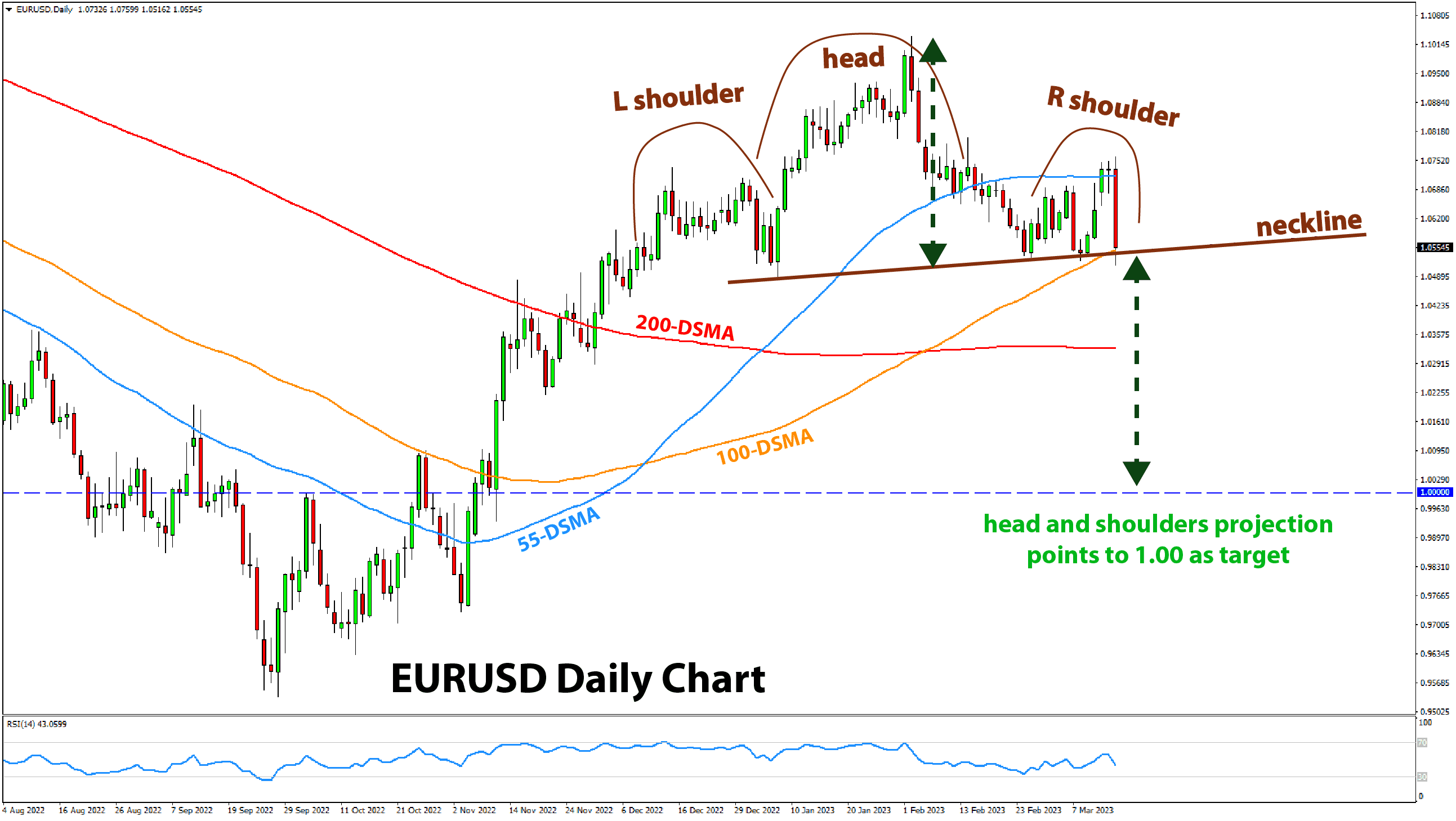

The technical picture in EURUSD has shifted a lot in recent weeks, from bullish to neutral to some bearish signs appearing now. The main highlight is that a bearish head and shoulders pattern can potentially come into play, if it is triggered with a break below the 1.0550 support, where its neckline is located

(chart shown below).

Credit Suisse the European Version of SVB in the US?

In what has been crazy 5-7 trading days since last Tuesday, we’ve seen central bank rate hike expectations swinging massively up to now massively down. The Silicon Valley Bank failure in the US and today’s troubles of Credit Suisse in the Eurozone have investors cut their bets for more rate hikes from either the ECB or the

Fed. In the Forex market, the euro is in central focus with that ECB meeting tomorrow. Volatility is guaranteed, with the current situation around Credit Suisse making their decision that much more difficult. Today’s sharp drop quickly took EURUSD to this

1.0550 neckline support, and only a small further push lower is needed for a break to be confirmed.

EUR Under Strong Bearish Pressures

With Swiss bank Credit Suisse’s troubles mounting and its stock price plunging by 30% today, expectations for ECB rate hikes have shrunk accordingly. Consensus forecasts no longer expect the 50bp rate hike with 100% probability, meaning that a smaller 25bp is now the more likely scenario. If the ECB caves in under pressure and hikes only by 25bp (or doesn't hike at all), this will be bearish news for the euro currency, and EURUSD will likely drop below 1.0550. Below we show the daily chart of EURUSD, which is now on the verge of breaking that head and

shoulders neckline around the 1.0500 - 1.0550 zone. The neckline connects and is located right in this area which also coincides with the 100-day moving average (orange line). A technical break below this zone, with a completed daily close below the neckline and 100 DMA, would be a huge bearish signal for EURUSD.

Market positioning is still long EURUSD, which was built during the rebound in the autumn and winter period. This 1.0500 - 1.0550 zone that is now being tested is likely the key to this

bullish/bearish sentiment turning point. A bearish break here should lead to the capitulation of many EURUSD bulls. This by itself can then set off a faster decline lower. To the downside, 1.03 and then parity (1.00) stand out as the next support zones lower. These can be used as targets on a short trade. The projected target of the head and shoulders pattern, as can be seen in the chart above, is also at the parity zone (1.00).

Entry: - Wait for a bearish break of the neckline;

- Look for a short entry once the trigger signal

is completed

- The trigger signal is likely to come tomorrow on that ECB meeting, so watch out for that event

Stop loss: - Place decently above the

neckline;

- The stop can be placed at least above 1.06 - 1.0650, and even above 1.07 would be a very reasonable location to place the stop

Targets: - 1st - 1.03 - moderate support zone

(take some profits here)

- 2nd - 1.00 - main target, this is the head projection of the H&S pattern

Trade signals from the past weeks

- February 7, 2023 - Short EURCHF from 0.99 (open & in progress)

- February 23, 2023 - Long USDCHF from 0.9330, closed March 9 at 0.9360 = +30 pips

- March 9, 2023 - Short GBPUSD from 1.1910, stop triggered above 1.20, exit at 1.2050 = -140 pips

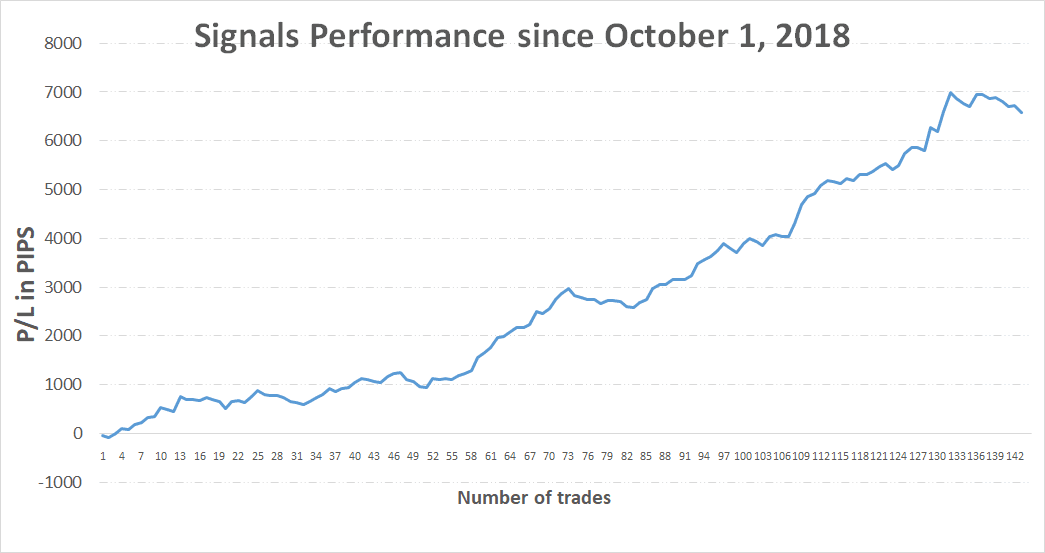

TOTAL P/L in the past weeks: -110 pips TOTAL: +6585 pips profit since October 1, 2018

If you have any questions or feedback, don't hesitate to reply to this email.

Thank you!

P.S. Email providers such as Gmail and Yahoo! Mail sometimes place messages in different folders or tabs (often in the promotions tab). You can whitelist my email address to ensure that all trade signals I send will end up in your (primary) inbox folder.

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Any opinions, news, research, predictions, analyses, prices or other information contained in this newsletter is provided as general market commentary and does not constitute investment advice. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. |

|

|

|