Following the Monday rally driven by the positive news regarding Brexit, the pound is trading lower again, and yesterday was again rejected sharply from higher levels.

Certainly, the press conference between UK PM Rishi Sunak and EU's President Ursula Von Der Leyen Monday was received well by the markets. They announced they've reached a deal about Northern Ireland. This is a positive for

the pound, however, it's unlikely to have a big impact considering the (small) size of Northern Ireland and the potential economic impact it could have.

So, with the reaction now having settled, the global and risk sentiment factors are back as the main drivers for GBP. Bank of England rate hike pricing is also running a bit high, with markets expecting 3-4 more 25bp hikes. However, just yesterday, BOE Governor

Andrew Bailey poured cold water on those expectations, saying he sees "no pressing need for more rate rises". GBPUSD fell by 60 pips within an hour and around 100 pips after two hours of the Andrew Bailey news release.

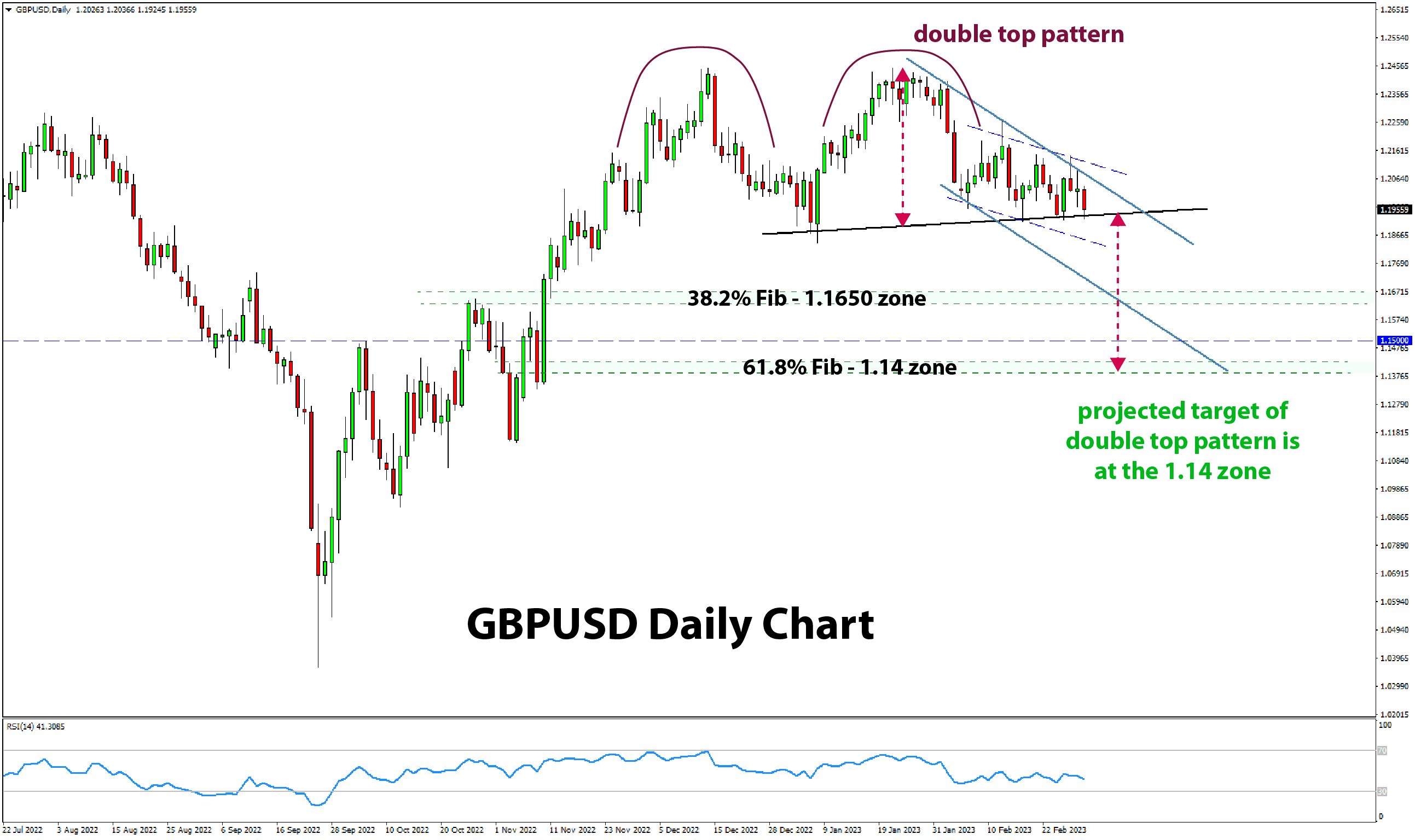

Any further news that the BOE is likely to deliver fewer than the 3-4 hikes expected should drive GBP materially lower. For GBPUSD, the chart is at a key juncture (more below), which coincides with the

crossroads at which GBP finds itself in the fundamental sphere.

A bearish catalyst related to BOE rate hikes or some other factor (e.g., worsening risk sentiment) will result in a breakout of the key support zone. At the same time, US fundamentals started to improve again, causing the USD to rebound by the most in five months. A stronger dollar should provide an additional push for lower GBPUSD.

Below, we discuss the details and the trade idea based on this

development.