FxTR Profitable Forex Newsletter

Hey! This is Philip with this week's edition of the FxTR Trade Idea

Newsletter!

The broad USD rebound is extending in the Fx market,

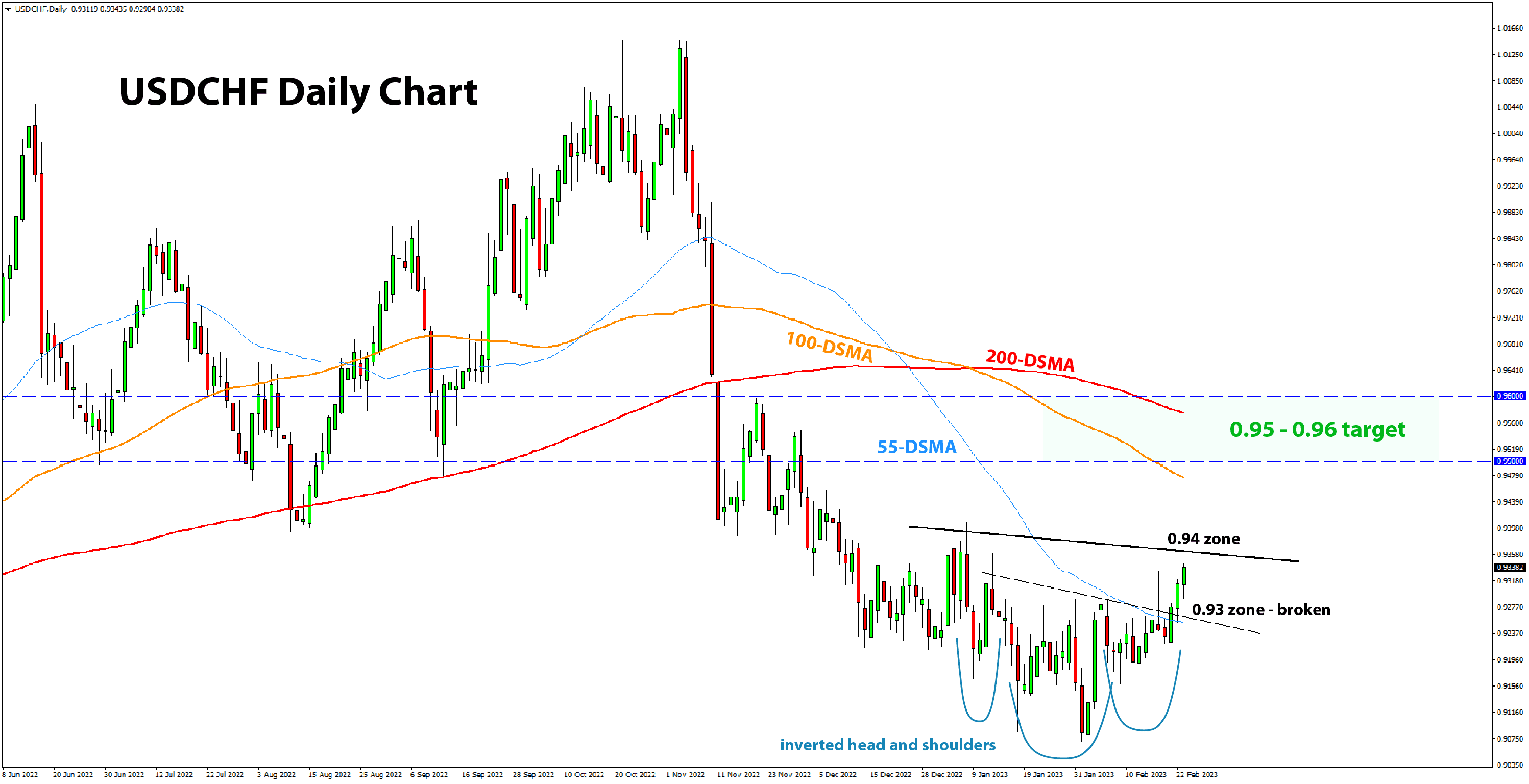

and more bullish breakouts are occurring in USD pairs. Some of the major pairs like EURUSD, GBPUSD, and USDJPY have clearly turned from USD negative to at least neutral or even USD bullish. USDCHF is another major Fx pair where a bullish breakout is transpiring this week. For instance, USDCHF is

close to completing an inverse head and shoulders pattern, with a break above the 0.93 zone. This is a bullish pattern and indicates around 200 pips more upside in USDCHF based on the projected target of the head and shoulders pattern (measured from the height of the head).

USDCHF likely to rise toward 0.95

The overall USD fundamentals are now turning bullish,

following that stellar January NFP report released three weeks ago. The dollar is climbing higher since then, and USDCHF is no exception. US Treasury yields have also resumed their rise and are one of the main factors supporting the dollar. We discuss the bullish USD dynamics in the weekly Fx released this Monday. The market narrative is now shifting from “the Fed is about to turn dovish” to the “Fed will

stay hawkish for longer”. The speculation for a dovish Fed pivot was the main reason behind the USD decline from October to January. The story is now shifting back in USD’s favour, and some more bullish action seems likely as the markets adjust and reprice those expectations.

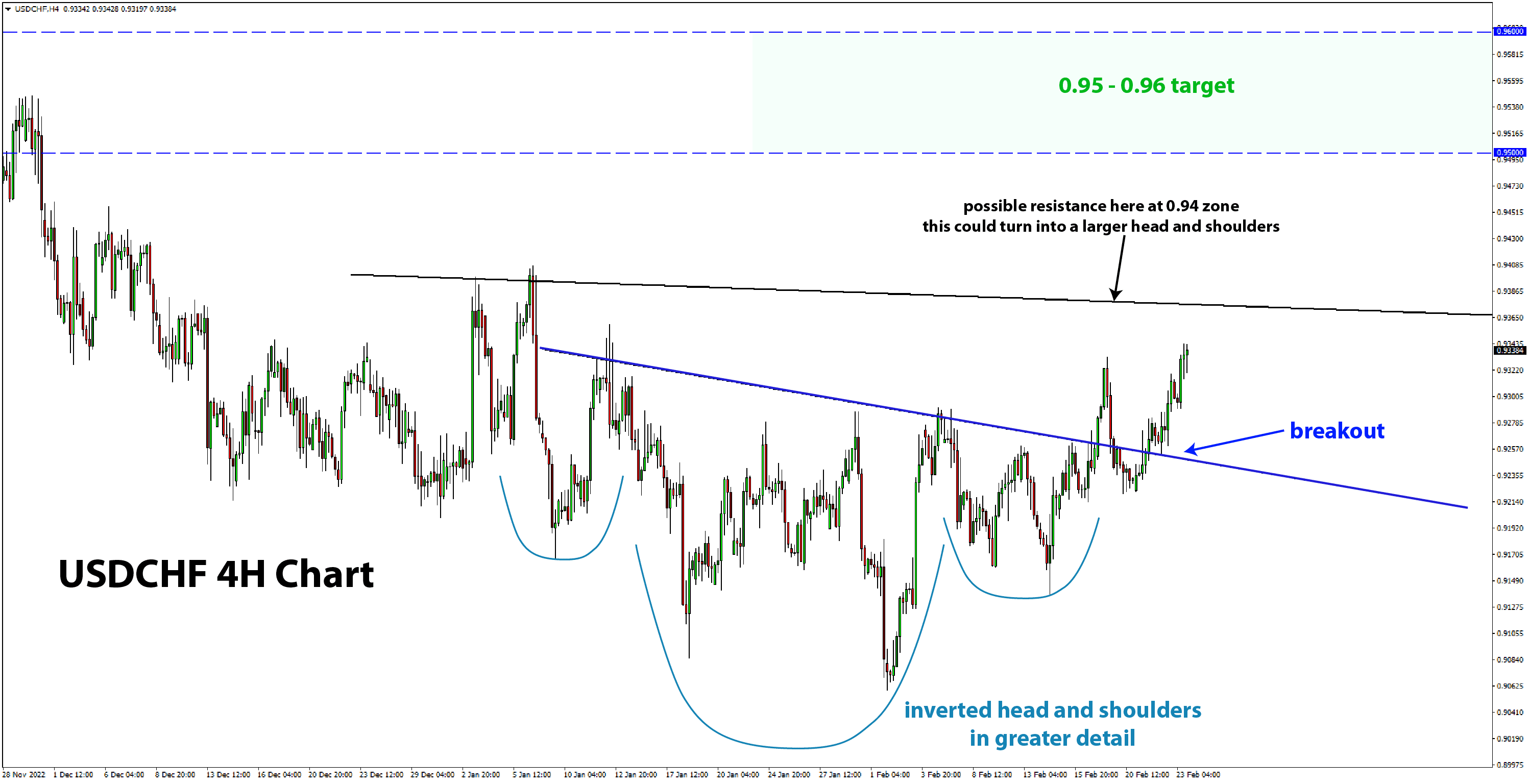

The chart above shows the inverse head and shoulders

pattern. The current situation is not that distinct as the many upward, and downward swings give the potential for double or triple head and shoulders to occur. Nonetheless, the chart action is bullish here, and that is clear. The break above the 0.93 zone is the first more serious bullish sign and has completed the first smaller head and shoulders (see 4H chart below). The next resistance that needs to fall is the 0.94 zone. This will definitely complete the larger head and shoulders pattern (see daily chart above).

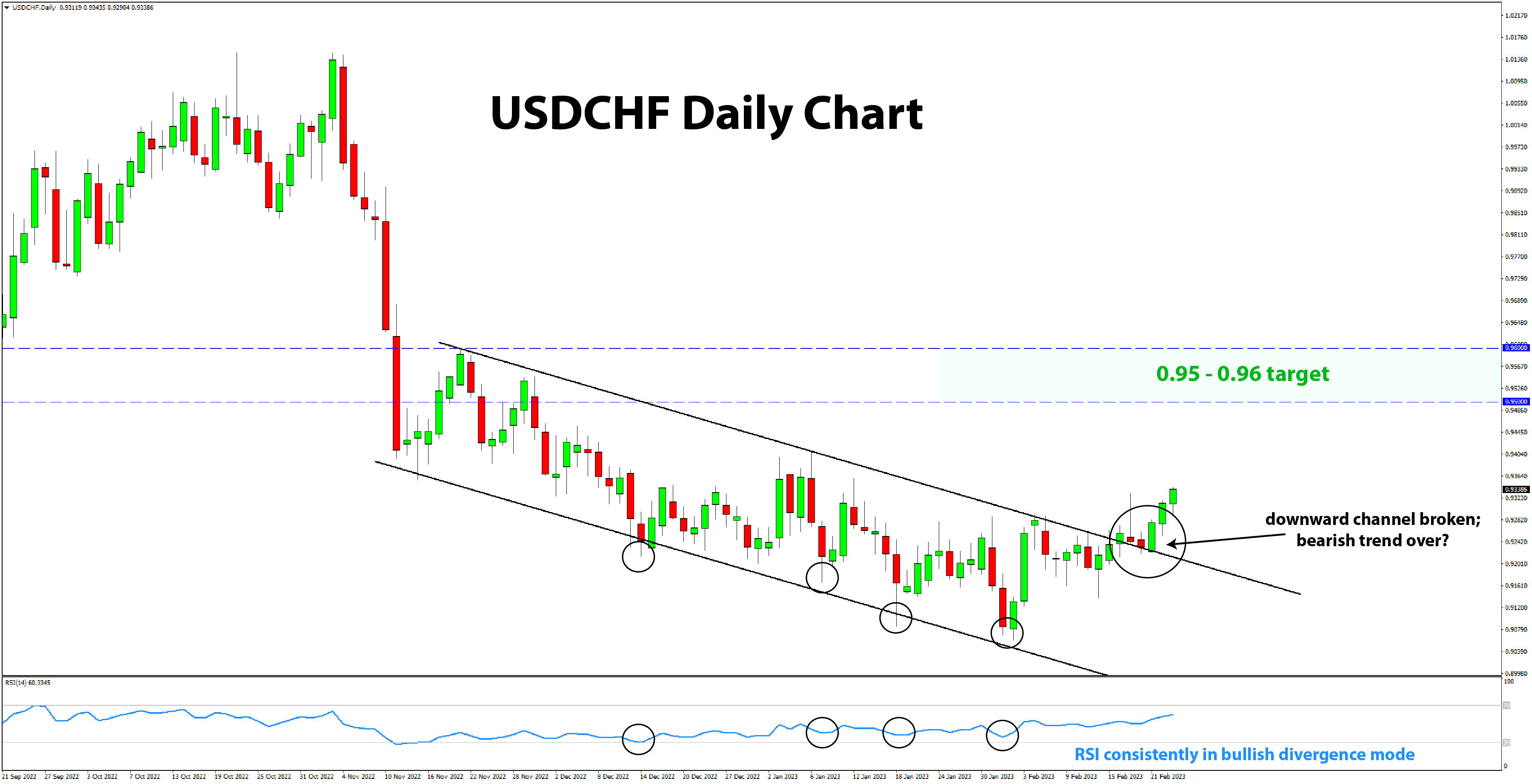

Importantly, the daily chart also shows a

completed bullish breakout of the downward channel since November. This is a strong bullish signal by itself that suggests USDCHF has bottomed for this cycle that lasted since October/November. Thus, a long entry at current levels is acceptable, given the confirmed bullish signals. A further breakout above 0.94 will additionally confirm the bullish turn in USDCHF. However, there is a chance that we may first get a reaction at 0.94

which may cause another move down before USDCHF moves higher again.

Entry: - Long entry around current levels of 0.9330

Stop: - Under 0.92; This is both below the broken downward trendline of the channel and the low of the right shoulder of the H&S pattern

Target: - 0.95 - 0.96 zone

- If the bullish move gains momentum, USDCHF could push further higher, toward the 0.98 zone

Trade signals from the past weeks

- February 7, 2023 - Short EURCHF on breakout below trendline (0.99 zone), open & in progress

- February 16, 2023 - Long USDJPY, trade not triggered - while we were correct about the direction, USDJPY continued to move higher without giving a correction first

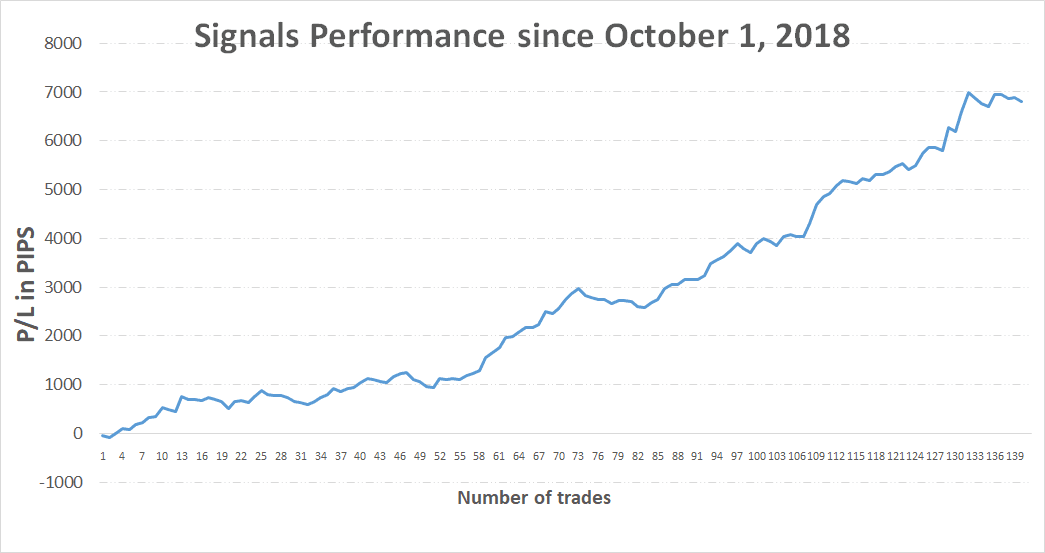

TOTAL P/L in the past weeks: N/A TOTAL: +6695 pips profit since October 1, 2018

If you have any questions or feedback, don't hesitate to reply to this email.

Thank you!

P.S. Email providers such as Gmail and Yahoo! Mail sometimes place messages in different folders or tabs (often in the promotions tab). You can whitelist my email address to ensure that all trade signals I send will end up in your (primary) inbox folder.

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Any opinions, news, research, predictions, analyses, prices or other information contained in this newsletter is provided as general market commentary and does not constitute investment advice. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. |

|

|

|