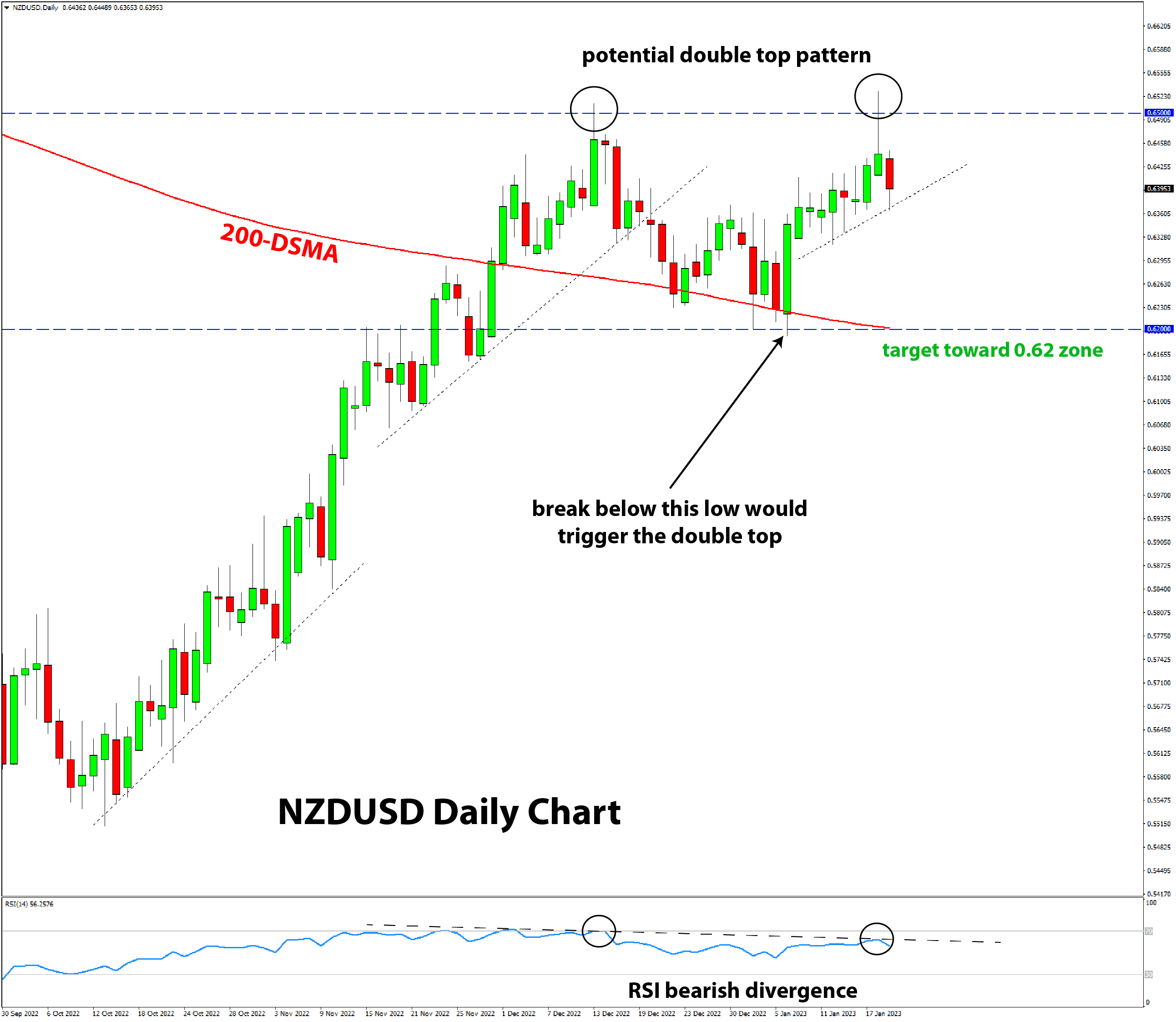

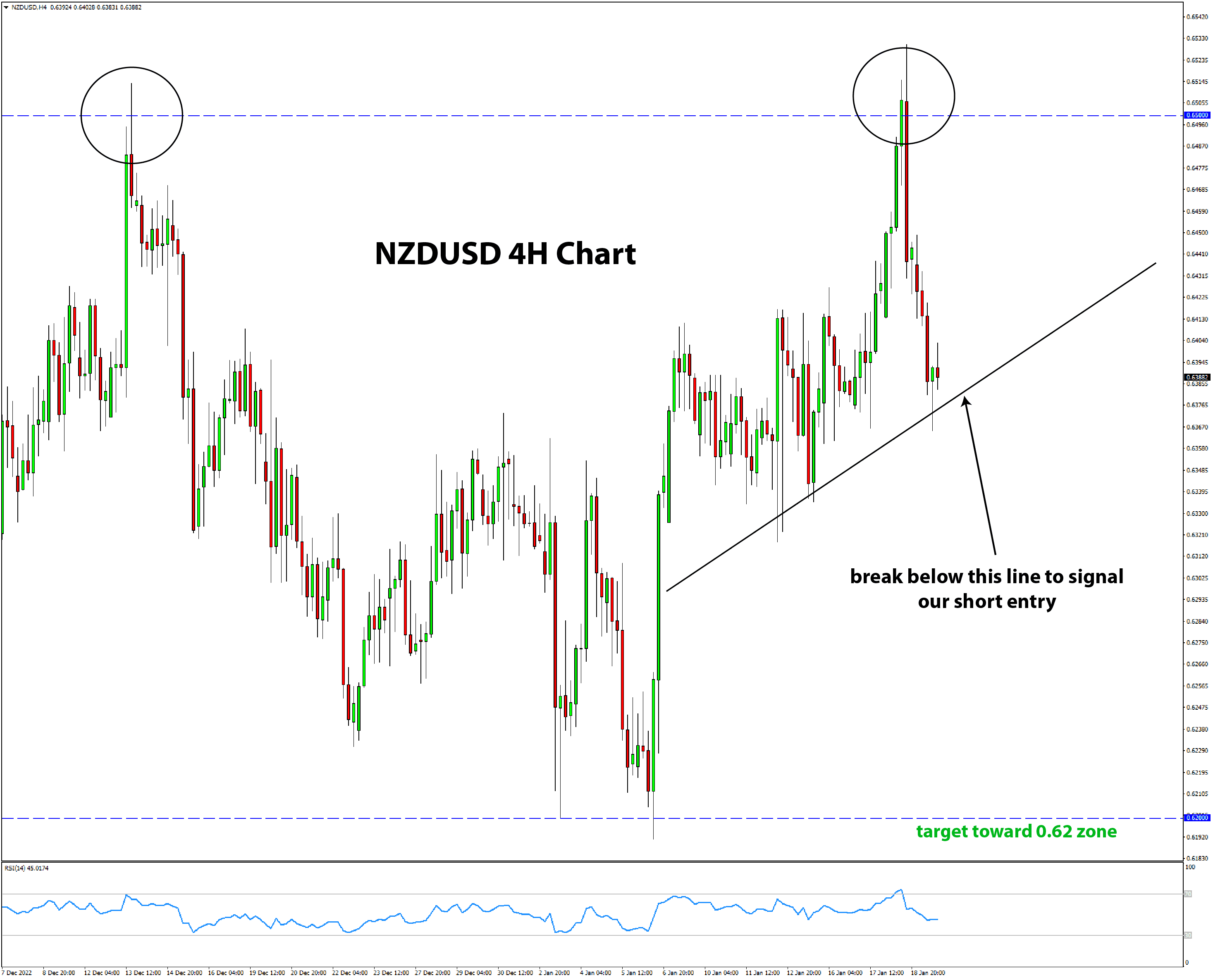

There is obviously a potential for a bigger reversal play here via a double top pattern, which if completed, could signal wider bearish implications for NZDUSD. However, for this tactical trade idea, we are focusing on the short term and are playing on the recent rejection at 0.65

as part of a horizontal trading range (between 0.65 and 62). Our target is toward the 0.62 zone at the lower end of the range.

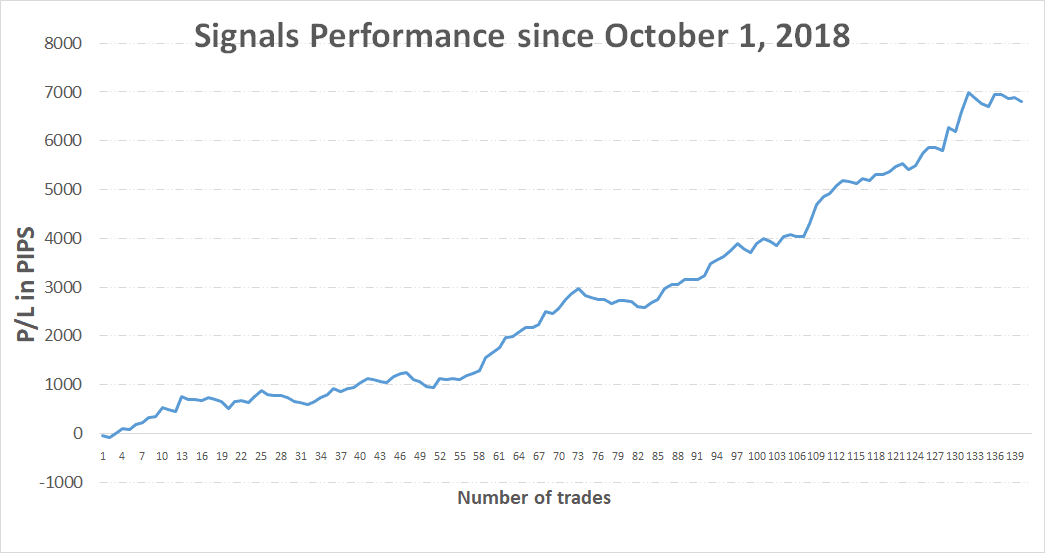

Taken together, all those signals in the current overall picture and at the technical juncture suggest NZDUSD may be ready to move lower now. The risk-reward is sufficient

based on the predetermined stop loss and TP target distances (as described below).