Free Profitable Forex Newsletter

Hey! This is Philip with this week's edition of the Free Profitable Forex

Newsletter!

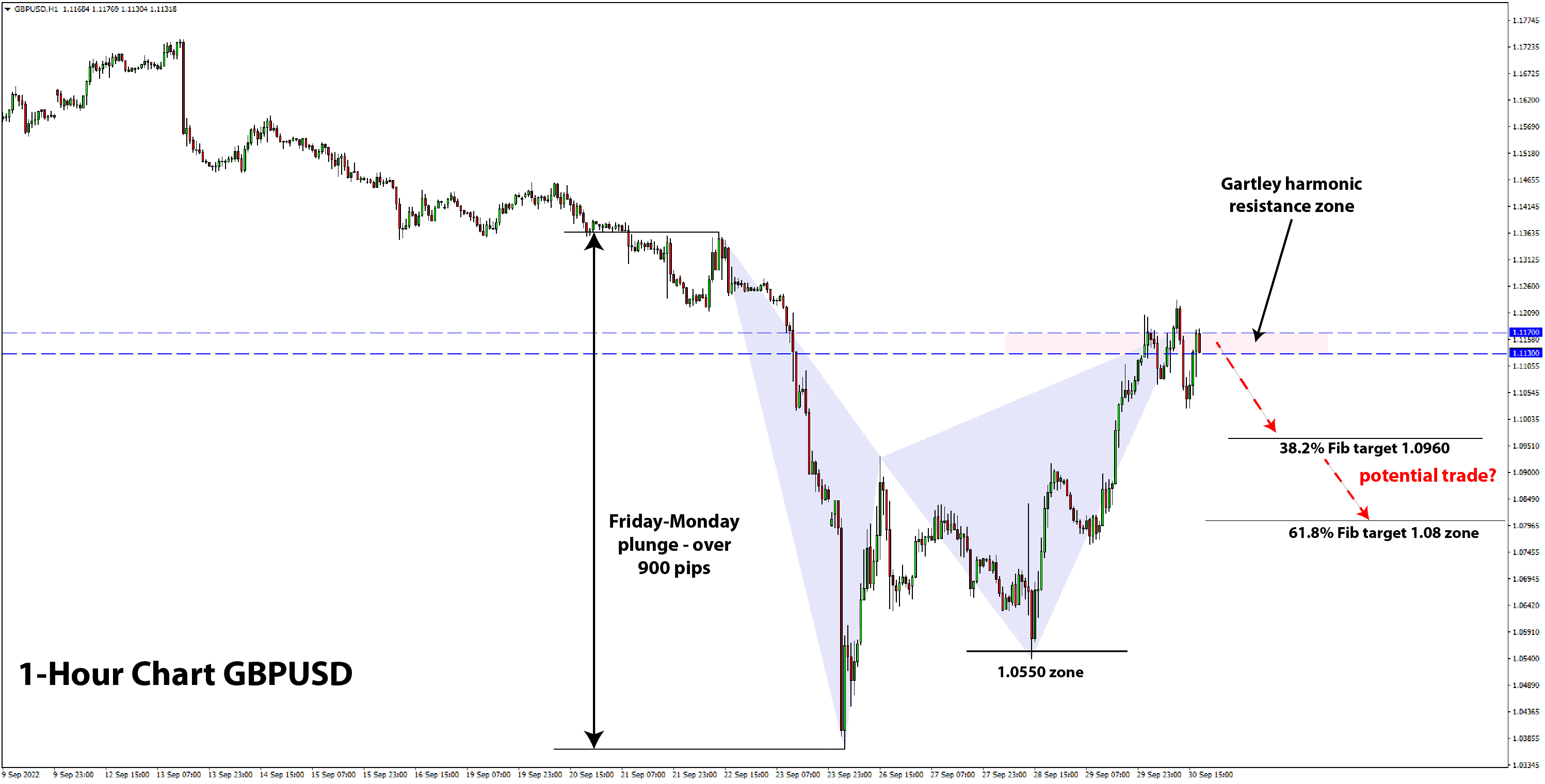

It’s been an extremely volatile week of trading on GBP crosses. A trading range of over 900 pips since last Friday means volatility is here to stay for a while and more large swings are likely in both directions. Vigilance is as needed as ever in times like this, but also great opportunities can exist in extreme

market conditions. GBPUSD has already fully retraced the big plunge from last Friday, as it traded above 1.12 earlier today. However, it is now already moved by a “small” 100 pips lower, near 1.11. Don’t be surprised if such 100-200 pips are the “new normal” for GBPUSD. Considering this, we could easily see

the pair trading toward the bottom of the range around 1.06 - 1.05 already next week. GBPUSD will remain very sensitive to news headlines from the new UK Government and their budget plans and fiscal policy. The proposed simulative fiscal measures (officially announced last Friday) were

taken badly by the market, which sent the pound tumbling to a low of 1.0335 versus the dollar (this Monday).

Looking for a move back toward 1.08

In such volatile conditions, it is often better to wait for some calm instead of trying to trade during the storm. In this case, we are starting to see some calm in GBP pairs (after the BOE intervened in the bond market), so it may be soon time to think about some potential trades. Given the overwhelming bearish

fundamentals for GBP (given the Ukraine war and European gas, power crisis), we would only look for potential setups to enter short GBPUSD. In this sense, the fundamentals and the technicals suggest GBPUSD could move down toward the 1.08 area fairly soon again. Looking to short above 1.11

and 1.12 could be a good opportunity, as these were formerly support zones (until last week), so they are likely to now act as resistance.

There is a harmonic Gartley pattern on intra day timeframes (see 1H chart above), which points at the 1.1130 - 1.1170 zone as the harmonic resistance. Indeed, GBPUSD already reacted here today and the bullish attempt was rejected, although there is another

attempt underway as of this writing. Still, the harmonic Gartley pattern, like the larger timeframes, suggests that 1.08 could be reached next and is the 61.8% harmonic target. Thus, we are looking to enter short GBPUSD around current levels next week, with a tight stop above the most recent swing

high. To negate the bearish bias, GBPUSD would need to decisively move above 1.14, a scenario that currently is hard to imagine and looks very unlikely.

Entries: - Look to short around current levels (1.1150) or higher if possible;

- Bearish signals above 1.1200 could be particularly attractive for entering

short

Stop loss: - Above the most recent swing high; i.e., somewhere around the 1.12 zone

- Be careful of the volatility, as this mean GBPUSD can easily spike even above 1.13

e.g., and then still eventually resume the fall toward 1.08 or lower.

Targets: - 1.08 zone - Look for GBPUSD to fall back toward the 1.08 zone, and perhaps lower toward 1.05 near the bottom of the volatile range

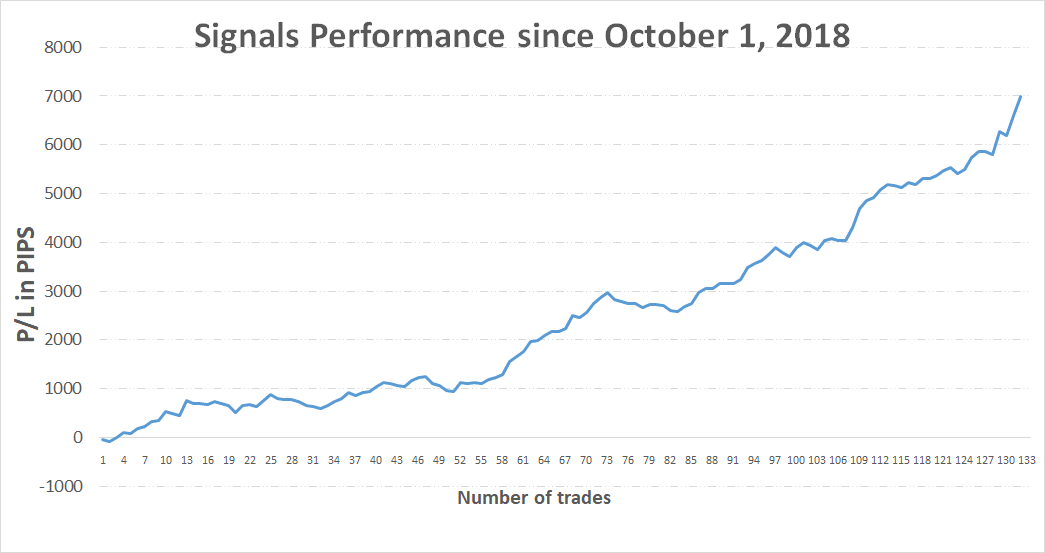

Trade signals from the past weeks

- September 15, 2022 - Short NZDJPY from 0.86, 1st target at 0.82 reached = +400 pips profit

- September 9, 2022 - Short EURUSD from 1.0050, 1st target at 0.98 reached for +250 pips, in progress toward 2nd target at 0.95 (trade idea sent Sep 2)

- Potential short EURGBP - not triggered, setup

canceled (trade idea sent Sep 22)

TOTAL P/L in the past week: +400 pips TOTAL: +6995 pips profit since October 1, 2018

If you have any questions or feedback, don't hesitate to reply to this email.

Thank you!

P.S. Email providers such as Gmail and Yahoo! Mail sometimes place messages in different folders or tabs (often in the promotions tab). You can whitelist my email address to ensure that all trade signals I send will end up in your (primary) inbox folder.

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Any opinions, news, research, predictions, analyses, prices or other information contained in this newsletter is provided as general market commentary and does not constitute investment advice. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

|

|

|

|