Strong Nonfarm Payrolls last Friday and a much stronger ISM services index this Monday confirm that the US economy is in much better shape than Europe and other developed peers.

We are already seeing the broad DXY dollar index rebounding from a key technical area — which, although currently not fully confirmed — may finally prove the end of this corrective leg.

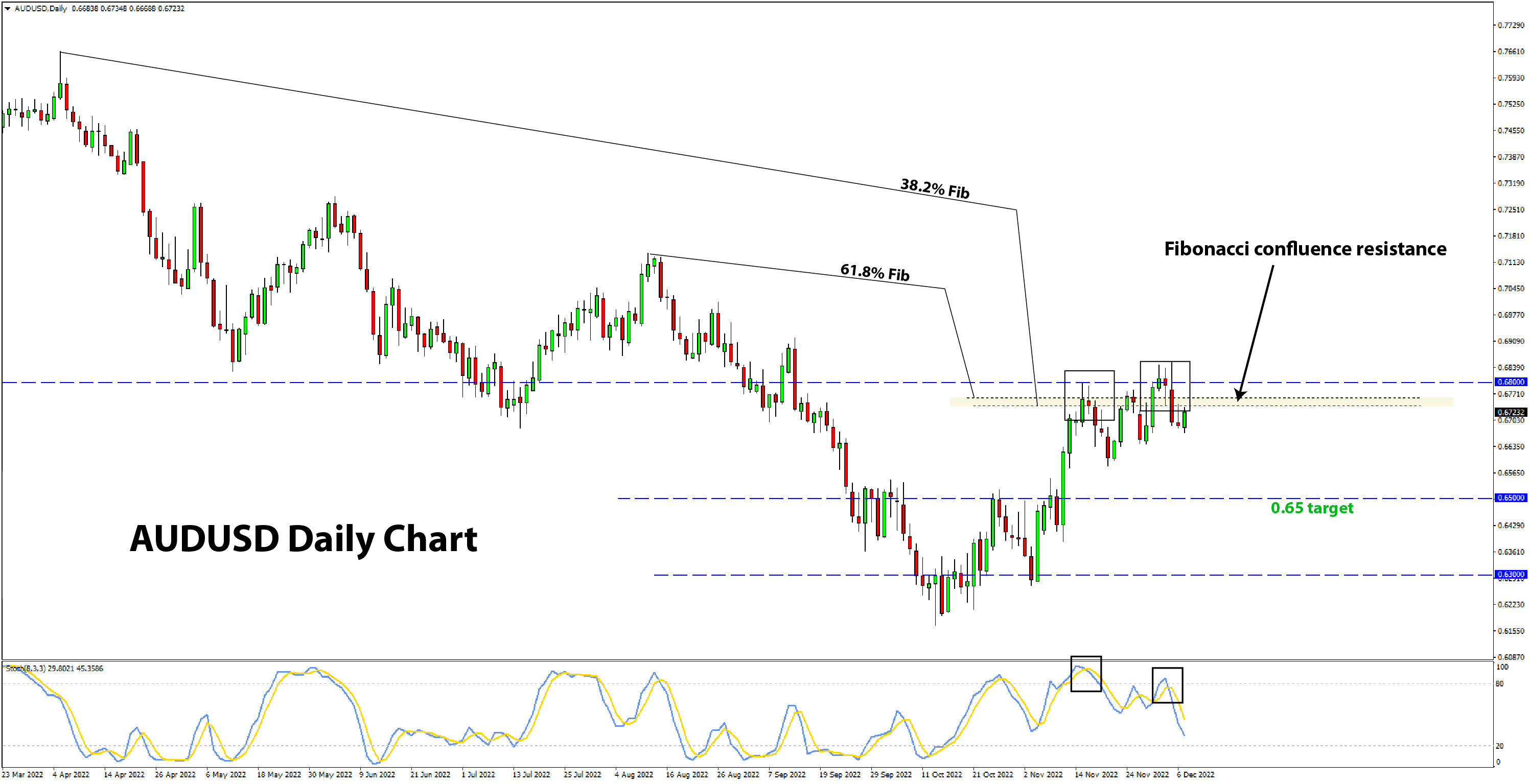

Below, we look at how we can trade this USD rebound via a short AUDUSD position. The recent resilience in

US data, just a week ahead of the Fed meeting, coupled with another dovish RBA meeting this week, looks like a good combination to push AUDUSD lower. Global stock indices (S&P 500, NASDAQ) - another important driving factor for currencies like the Aussie, are also hitting resistance and turning lower so far this week. A potentially bigger move down in stocks

should surely add pressure on pairs like AUDUSD.