Fed Chairman Powell is in focus tonight. He is scheduled to give a

speech on the economy (19:30 CET) and will attract a lot of attention, especially in the current context of so much speculation about a Fed “pivot”. He is likely to retain the hawkish tone and push back against rumours that the Fed will be cutting rates next year. This should be hawkish, and even if it doesn’t prove a big bullish event for the USD, Powell’s speech should at least offer some moderate support for the dollar.

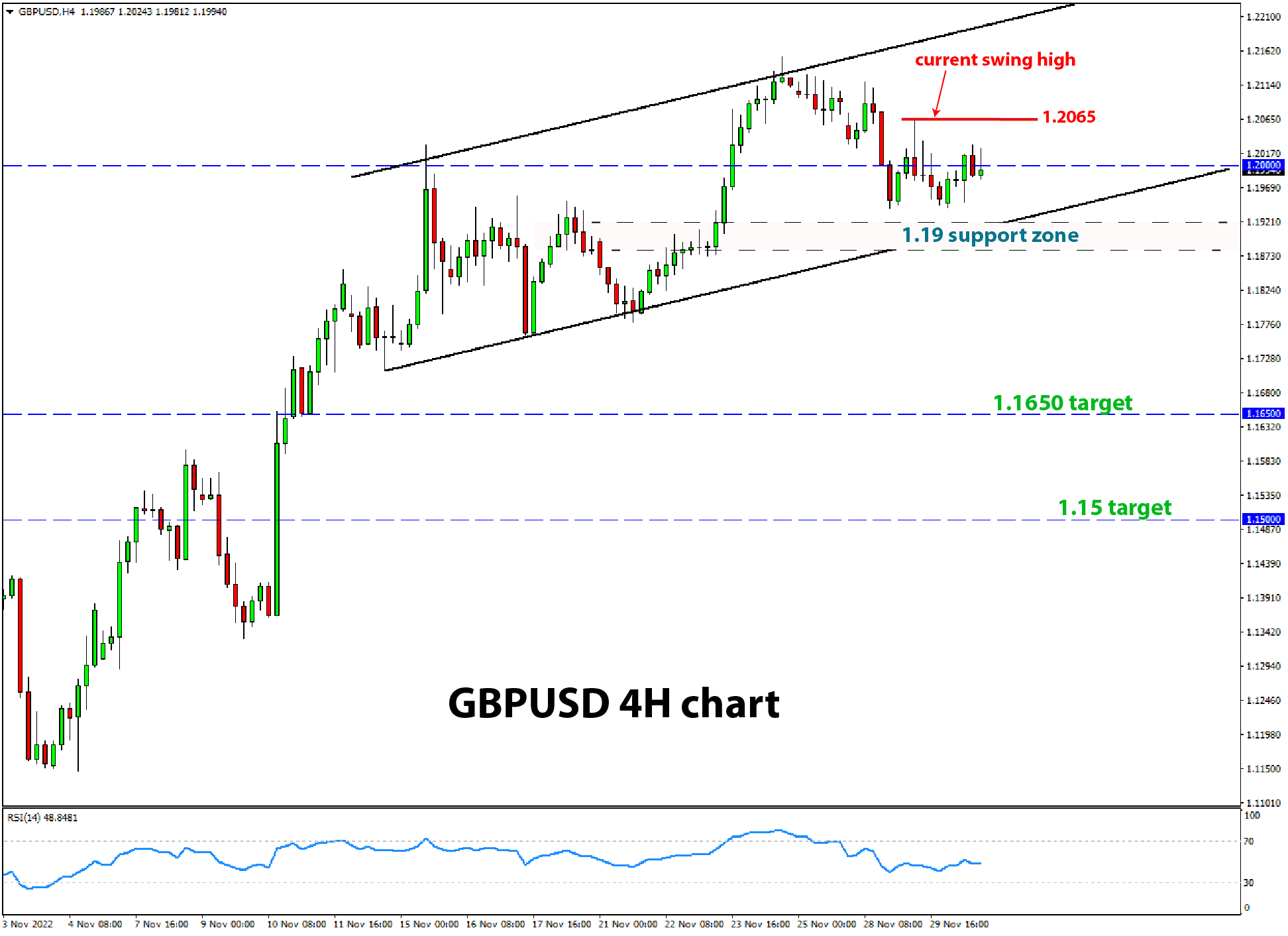

And if Powell is very hawkish, he may cause a new bull leg in USD. This could be the event that helps to break the key support zone on some USD pairs like GBPUSD discussed above.

The other big event, the Nonfarm payrolls report on Friday, should also help to keep the dollar broadly supported, barring a big miss in expectations. The consensus forecasts put the NFP at 200K and the unemployment close to the prior month of 3.7%. If the jobs reports come in close to those expectations, then there is hardly a reason for the USD to extend the correction down. In fact, quite the opposite would be more likely, once some key technical zones are broken.

For GBPUSD, that technical zone seems to be 1.19. Once it breaks, a further move down should be much easier to come by.