Free Profitable Forex Newsletter

Hey! This is Philip with this week's trade idea of the Free Profitable Forex

Newsletter!

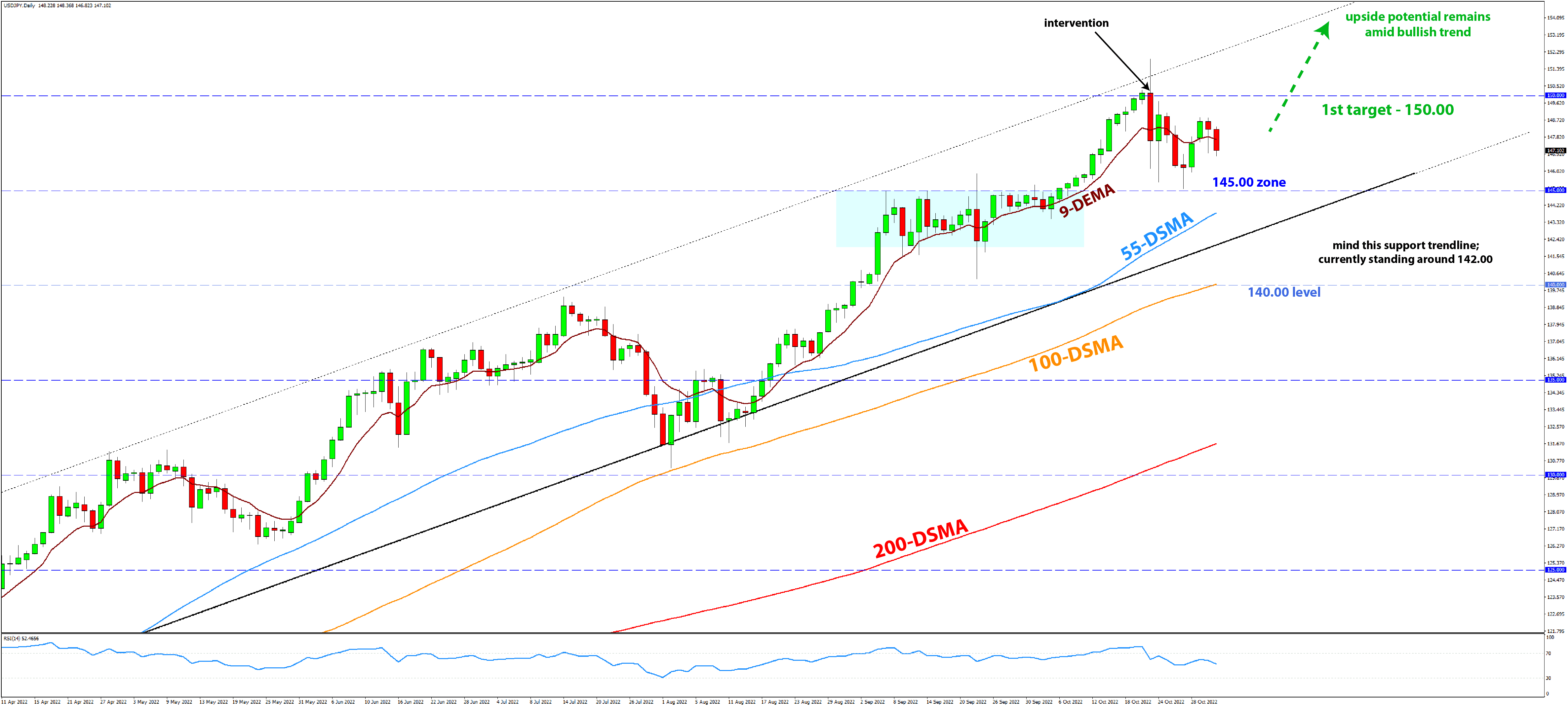

USDJPY remains notably off the highs since the BOJ/MoF intervention on October 21 from levels above 150.00 pushed the pair down to almost 145.00. In addition, the coincidental

broad correction in the US dollar (e.g., other USD pairs and the DXY index corrected) also helped to push USDJPY down and made things easier for Japanese authorities with their intervention. USDJPY is now in consolidation since then, and it appears this can continue for some time more, perhaps even a few weeks. Looking at the bullish channel since March, we can see that USDJPY is currently in the middle zone of the channel (see chart). A deeper correction (toward 142.00) or a prolonged sideways consolidation (till mid-November) is

needed for USDJPY to reach the lower end of the channel at the support line. As we have discussed in our recent weekly Fx posts, the trend in USDJPY remains strongly bullish for very clear fundamental reasons. The BOJ is the most dovish central bank, and while almost every other central bank is hiking rates and doing QT, the BOJ is holding swiftness at 0% and doing QE. Therefore, it still makes sense to look for

tactical short JPY positions, even with the risk of occasional interventions by Japanese authorities.

Fed meeting tonight could lift the dollar

The 145.00 zone is the obvious, clear support for USDJPY. It could be a good entry area for long positions if USDJPY corrects down there again. It’s also near the 55-day moving average

(blue), while the 100-day MA (orange) currently seats around 140.00 at the lower end of the channel.

The big event today is the Fed meeting tonight. Recently, there was a lot of speculation about what they may signal for future rate hikes and whether they may slow down the hiking cycle from next month. This is the key

question going into today’s meeting that can move all USD pairs, but also other markets like stocks and precious metals. For today, a 75bp is a near “certainty”; it was well-telegraphed and is almost fully priced in by markets. If the Fed, on the other hand, remains hawkish, it will disappoint some USD bears who are hoping for a dovish “pivot”.

This could be a catalyst for a new bull USD leg and could as well see USDJPY moving toward 150.00 again. Nonetheless, given the likely volatility around the event, we should all be careful about how we take trades and the position size we assign to each trade.

Entry: - Look for USDJPY to make another downside attempt toward 145.00; Perhaps that could come tonight around the Fed meeting;

Then a bounce at the 145.00 zone is likely, which (if it occurs) can be used to establish fresh long positions.

Stop loss: - The trend will remain intact as long as USDJPY is above 140.00 and the band of 55 and 100 DMAs (see chart);

So, technically speaking, a stop loss under this zone would be appropriate. However, it would be too wide (500) pips for a short-term tactical trade; That’s why better look for a strong-convincing entry signal around the 145.00 area before

triggering a long entry;

Otherwise, better to wait as USDJPY may test levels below 145.00, in which case the 142.00 zone could be the next support where we may get a bounce reaction.

Targets: - The 150.00 zone

- 155.00 would come into focus as the next target if

USDJPY pushes above 150.00

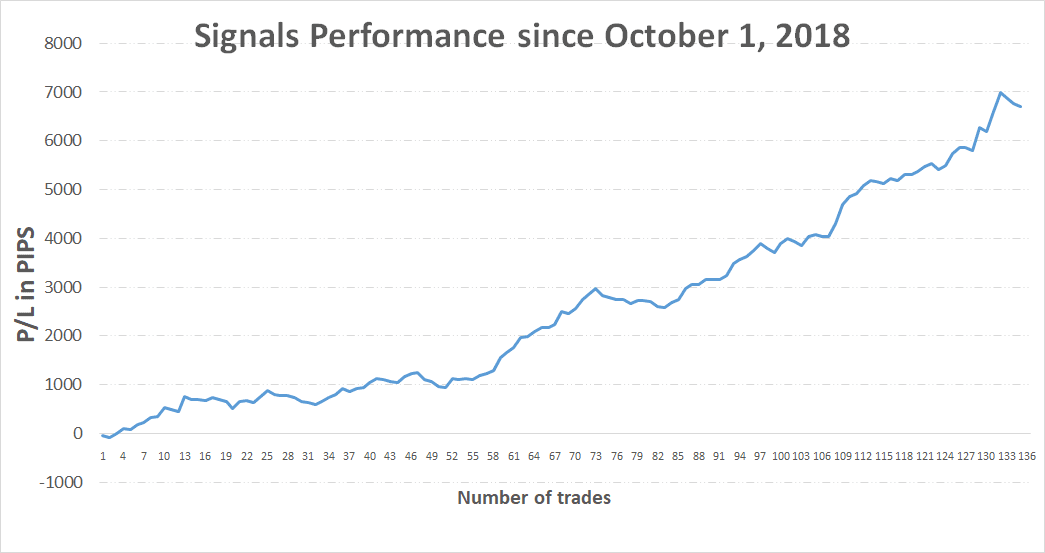

Trade signals from the past weeks

- September 9, 2022 - Short EURUSD from 1.0050, 1st target already at 0.98 reached for +250 pips, still holding open aiming for our 2nd target at 0.95 (signal sent Sep 2)

- October 24, 2022 - Long AUDNZD from 1.1050, stop triggered at 1.10 = -50 pips (trade idea sent October 7)

- October 14, 2022 - Short EURGBP from 0.87 (trade idea sent October 13)

- November 1, 2022 - Long USDCAD from 1.3585, open in progress

(trade idea sent October 28)

TOTAL P/L in the past week: -50 pips TOTAL: +6705 pips profit since October 1, 2018

If you have any questions or feedback, don't hesitate to reply to this email.

Thank you!

P.S. Email providers such as Gmail and Yahoo! Mail sometimes place messages in different folders or tabs (often in the promotions tab). You can whitelist my email address to ensure that all trade signals I send will end up in your (primary) inbox folder.

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Any opinions, news, research, predictions, analyses, prices or other information contained in this newsletter is provided as general market commentary and does not constitute investment advice. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

|

|

|

|