Free Profitable Forex Newsletter

Hey! This is Philip with this week's trade idea of the Free Profitable Forex Newsletter!

The bearish factors and long-term dynamics that are driving EURUSD lower are well-known by now, as we have discussed on multiple occasions

in our weekly Fx

analysis posts this year. EURUSD has recently reached the parity zone (1.00) again, and in the past two weeks, the price has been dancing around it without a decisive move up or down. Chances are the current range is what it looks like - another consolidation within a predominant trend that eventually will lead to downtrend continuation. Both the technical and fundamental factors indicate

more downside is in store for EURUSD over the coming weeks, and we better look to position for that.

Mixed reaction to NFP but bullish USD trend to be unaffected

The Nonfarm payrolls and other jobs reports from the US released today didn’t and likely won’t alter the

bullish USD trend much. The NFP component was in line with estimates, but the average hourly earnings (wage growth) and the unemployment rate were slightly worse than expected. Thus, we got a mixed market reaction in the USD and across other asset classes. Nonetheless, the overall report is still a healthy one and is unlikely to alter the Fed’s resolutely hawkish path to continue with aggressive tightening and rate hikes. Traders’ focus will now shift to the ECB meeting next Thursday. A 50bp rate hike is the minimum

markets expect, with non-negligible chances the ECB may deliver a larger, 75bp hike. Still, as we have said on several occasions here in the newsletter and in the weekly Fx analysis, no amount of hawkishness or rate hikes from the ECB can help the euro currency much. The Eurozone faces an extreme energy crisis, with gas and electricity costs skyrocketing,

while the United States does not. The Eurozone is likely headed into deep recession this fall and winter, while the United States is not. These are the major factors that are pushing EURUSD lower this year, and the trend doesn’t look like it has run its

course. A bearish target of 0.98 and 0.95 seems achievable for EURUSD over the coming months. On balance, a sustainable break below parity (1.00) looks like a more probable scenario now than a return above it, for example toward 1.05. By “sustainable”, I mean EURUSD breaks under 1.00 and stays there for at least the next few months. Depending on how the gas and energy crisis will evolve, there could be much more downside potential for EURUSD (0.90 or lower in more extreme scenarios). But for now, until a very extreme negative scenario becomes a reality, the market will continue to wonder by probing levels below and above parity. It looks like the

market has found some short-term equilibrium around the 1.00 zone, hence the consolidation we are getting. But the longer-term fundamental factors still remain poised in the bearish direction, with 0.95 becoming an increasingly achievable level.

Look to enter short toward the resistance trendline within the downtrend

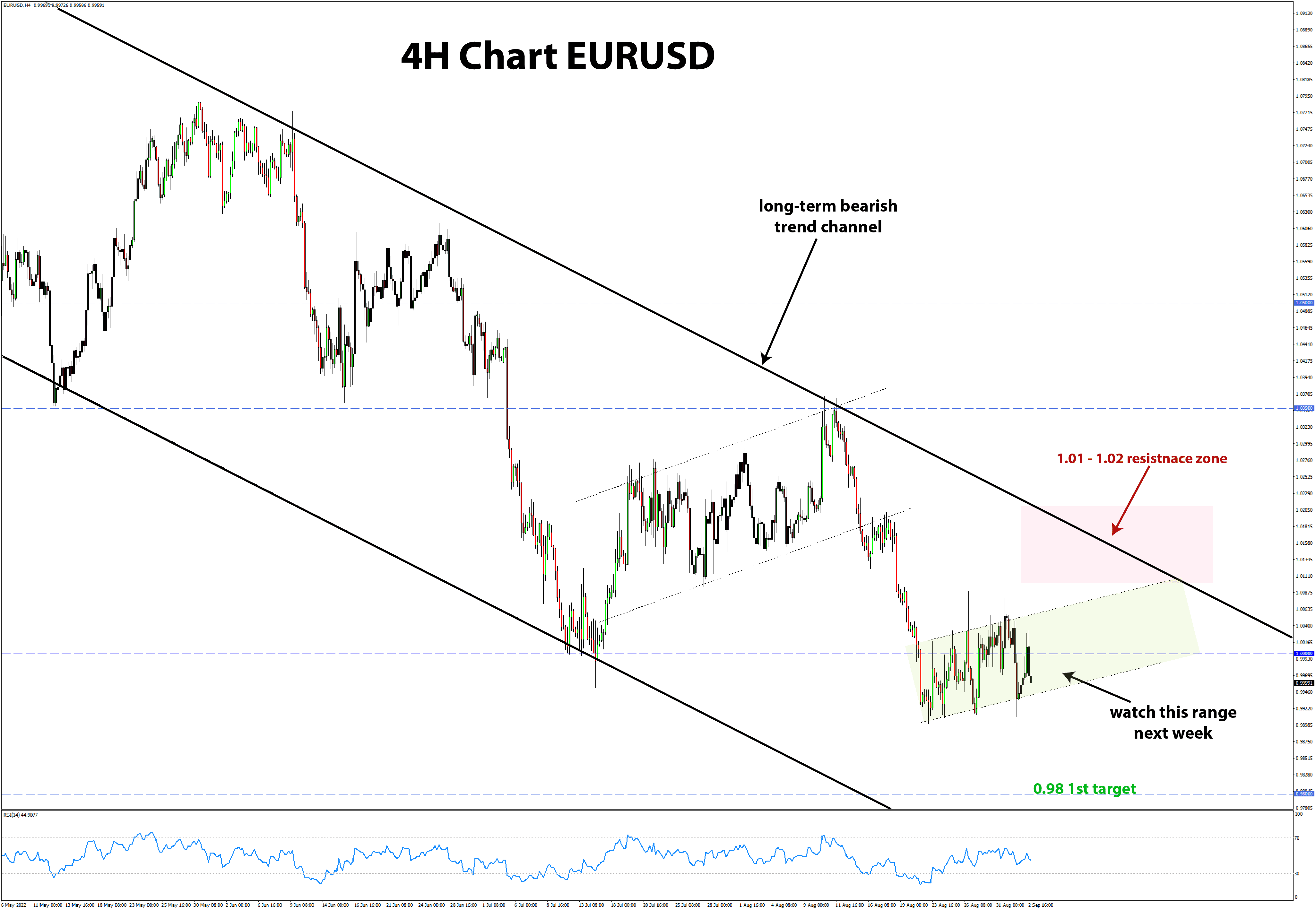

The most recent consolidation that started around August 23 appears clearly on the 4H chart shown below. On Monday, we

discussed the larger picture on the daily chart, while in today’s newsletter, we’ll look at how to potentially enter short. And for that, shorter-term timeframes like the 4H can provide more details and earlier

signals. For instance, we can see EURUSD is again trading in a formation that looks like a bear flag. It’s relatively simple to trade such consolidation, especially when it appears within a strong downtrend like now. The two main scenarios for the 4H chart from here are: - EURUSD will continue to grind higher to test the resistance trendline again (currently at 1.02, but could decline toward 1.01 in a few days)

- EURUSD will break the consolidation (bear flag) to the downside without climbing much higher.

The obvious event that could trigger a breakout is the ECB meeting next Thursday. It’s fairly probable that EURUSD may stay in the current consolidation until the meeting is past

us. In either case, even if EURUSD climbs toward 1.02 on the ECB meeting

(perhaps on some hawkish message from them), it would still be an attractive opportunity to fade that rally and look to enter short. As noted earlier, the ECB can’t do much to save the euro, so any rally next week could be an excellent opportunity to short EURUSD with good risk-reward.

Entry: - Watch the price action inside the flag (consolidative formation); EURUSD is likely to stay inside it into next Thursday’s ECB meeting when we will likely get a breakout;

- At that point, EURUSD will either be trading toward the 1.01 - 1.02 resistance (look to go short here); or breaking out to the downside (in which case the short entry will be at lower levels (probably around 0.99 or

lower)

Stop loss: - Placing the stop would obviously require a different approach based on the two scenarios:

- In scenario 1) - place it above the 1.01 - 1.02 zone

- In scenario 2) - look to place it above the most recent swing high (probably 1.00 or higher)

Targets: - 1st - 0.98 zone

- 2nd - 0.95 zone

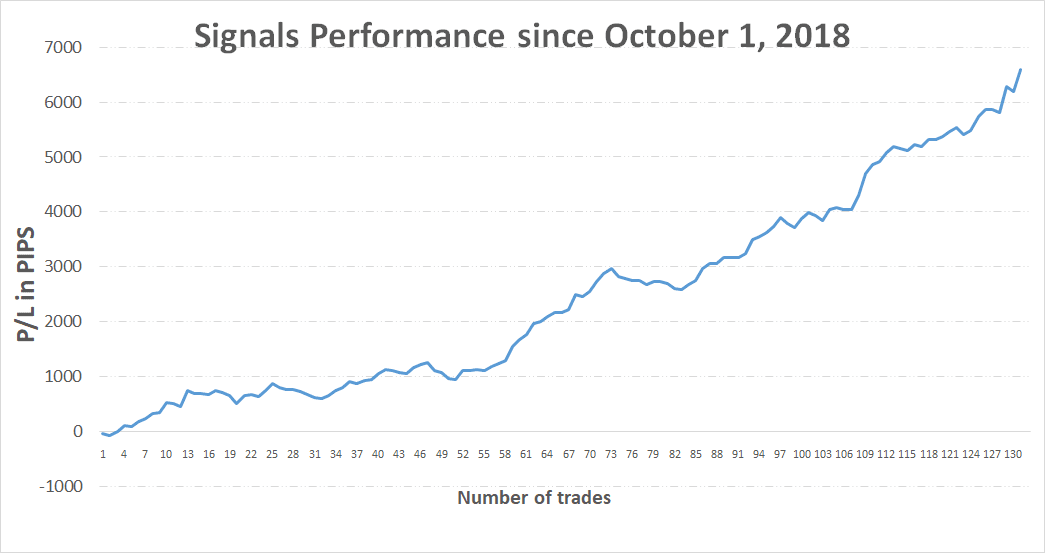

Trade signals from the past weeks

- August 15, 2022 - Short gold (XAU/USD) from 1780, ½ position closed at 1750 (Aug 23) ; 2nd half of the position reached the target at 1700 zone = $80 profit per one lot

bought (assuming a lot size of similar value for Fx pairs, this would equate to around 400 pips). Note there is more downside potential if gold breaks below 1700, with the 1500 area to come in focus next

TOTAL P/L in the past three weeks: +400 pips

profit TOTAL: +6595 pips profit since October 1, 2018

If you have any questions or feedback, don't hesitate to reply to this email.

Thank you!

P.S. Email providers such as Gmail and Yahoo! Mail sometimes place messages in different folders or tabs (often in the promotions tab). You can whitelist my email address to ensure that all trade signals I send will end up in your (primary) inbox folder.

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Any opinions, news, research, predictions, analyses, prices or other information contained in this newsletter is provided as general market commentary and does not constitute investment advice. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

|

|

|

|